Earning a high income doesn’t always guarantee financial security — and one Malaysian man’s story proves just that.

Recently, a man took to Threads under the handle @thekonjob to share how, despite earning RM10,000 a month, he still found himself living from one paycheck to the next.

A high salary ≠ financial security.

I was earning RM10k/month, yet still lived paycheck to paycheck.

Wealth is about leverage, not just hard work.”

His point about wealth being about ‘leverage, not just hard work’ highlights the importance of spending wisely and building income streams that don’t solely depend on active work.

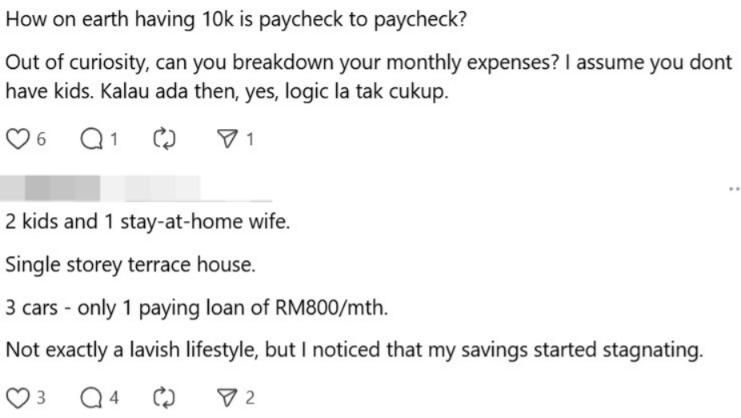

A modest life, yet savings stagnated

Responding to a netizen who asked how it was possible to be struggling with such a salary, especially if he had no dependents, the man clarified that he has two children and a stay-at-home wife. He lives in a single-storey terrace house and owns three cars, but is only servicing one loan of RM800 per month.

He admitted that while his lifestyle wasn’t extravagant, he noticed that his savings had started to stagnate.

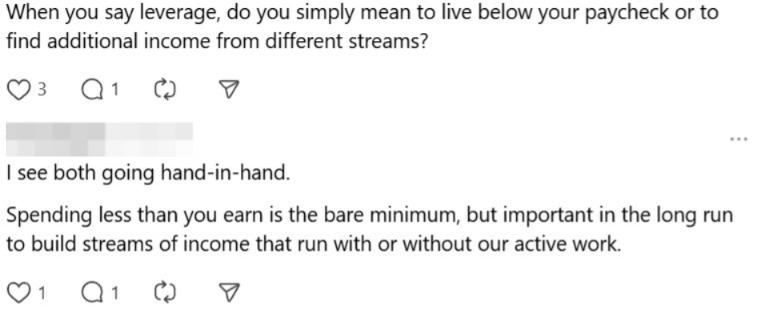

It’s not just about spending less

Another user asked whether by “leverage” he meant simply living below one’s means or exploring additional income streams. To this, he explained:

I see both going hand-in-hand.

Spending less than you earn is the bare minimum, but important in the long run to build streams of income that run with or without our active work.”

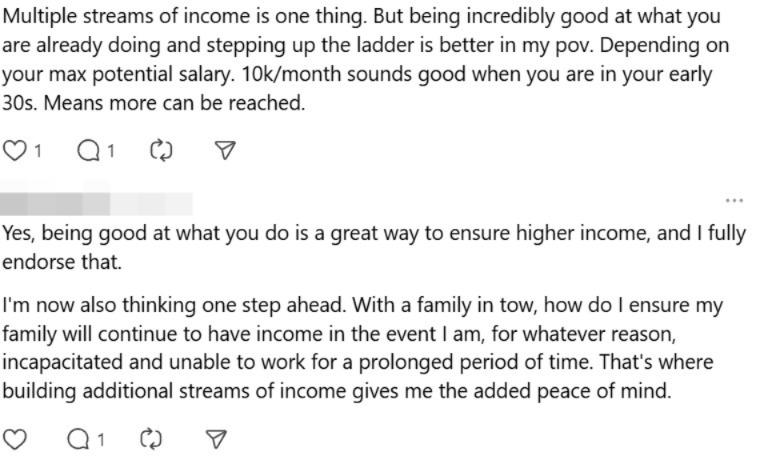

Planning for the unexpected

While he agreed that excelling at one’s job is a solid way to increase income, he shared that he’s now thinking a step ahead. With a family depending on him, he began to question how they would cope financially if he were ever incapacitated or unable to work for an extended period.

That’s where building additional streams of income gives me the added peace of mind,” he said.

Live within your means

Another netizen pointed out how rising income often leads to increased spending. They reminded that what truly matters is to avoid spending beyond your means.

What do you think about this? Share your thoughts with us in the comment section.

Here is the threads:

View on Threads

READ ALSO: